| HOME | SEARCH | ABOUT US | CONTACT US | HELP | ||

| |

| Montana Administrative Register Notice 42-2-909 | No. 11 06/12/2014 | |

| Prev | Next | ||

|

BEFORE THE DEPARTMENT OF REVENUE OF THE STATE OF MONTANA

TO: All Concerned Persons

1. On July 8, 2014, at 11 a.m., the Department of Revenue will hold a public hearing in the Third Floor Reception Area Conference Room of the Sam W. Mitchell Building, located at 125 North Roberts, Helena, Montana, to consider the proposed amendment of the above-stated rules. The conference room is most readily accessed by entering through the east doors of the building.

2. The Department of Revenue will make reasonable accommodations for persons with disabilities who wish to participate in this public hearing or need an alternative accessible format of this notice. If you require an accommodation, please advise the department of the nature of the accommodation needed, no later than 5 p.m. on June 27, 2014. Please contact Laurie Logan, Department of Revenue, Director's Office, P.O. Box 7701, Helena, Montana 59604-7701; telephone (406) 444-7905; fax (406) 444-3696; or lalogan@mt.gov.

3. The rules proposed to be amended provide as follows, new matter underlined, deleted matter interlined:

42.4.2701 DEFINITIONS The following definitions apply to this subchapter: (1) through (3) remain the same. (4) "Permanent irrevocable fund" means a fund comprised of one or more assets that are invested (5) and (6) remain the same.

AUTH: 15-30-2620, 15-31-501, MCA IMP: 15-30-2131, 15-30-2152, 15-30-2327, 15-30-2328, 15-30-2329, 15-31-114, 15-31-161, 15-31-162, MCA

REASONABLE NECESSITY: The department proposes amending ARM 42.4.2701 to update the definition of the term "permanent irrevocable fund" to coincide with revisions made to the Uniform Prudent Management of Institutional Funds Act with Senate Bill 108, L. 2013.

42.4.2703 ELIGIBILITY REQUIREMENTS TO HOLD A QUALIFIED ENDOWMENT (1) To hold a qualified endowment an organization must be: (a) incorporated or otherwise formed under the laws of Montana and exempt from federal income tax under 26 USC 501(c)(3); or (b) a Montana chartered bank or trust company, as defined in 15-30-2327, MCA, holding an endowment fund on behalf of a Montana or foreign (2) A qualifying gift to an institution meeting the definition in (1)(b) at the time of the gift remains a qualifying gift even if subsequent changes to the institution mean it no longer meets the definition of an entity eligible to hold a qualified endowment. For example, a qualifying gift to a Montana chartered bank remains a qualifying gift even if the bank is subsequently acquired and absorbed by a nationally chartered bank.

AUTH: 15-30-2620, 15-31-501, MCA IMP: 15-30-2327, 15-30-2329, 15-31-161, 15-31-162,

REASONABLE NECESSITY: The department proposes amending ARM 42.4.2703 to add more specificity regarding the eligibility requirements for holding a qualified endowment as provided for in 15-30-2327, MCA. The proposed amendments to the rule will protect taxpayers who are claiming the credit from losing their credit or being subject to recapture because of events beyond their control, and correct a federal statute reference formatting error. The department further proposes striking 90-6-133, MCA, as an implementing statute from the rule because it no longer applies.

42.4.2704 TAX CREDIT AND DEDUCTION LIMITATIONS (1) The credit allowed the corporation, estate, trust, or individual against its tax liability for a contribution of a planned gift is the percentage, as shown in the following table, of the present value of the allowable contribution as defined in ARM 42.4.2701. The credit allowed against the tax liability of the corporation, estate, or trust for a direct contribution is equal to 20 percent of the charitable contribution. The maximum credit that may be claimed in one year is $10,000 per donor. A contribution made in a previous tax year cannot be used for a credit in any subsequent tax year.

Planned Gifts by Individuals or Entities

Planned Percent Used to Maximum Gift of Present Calculate Credit Date Value Maximum Credit Per Year

7/1/03 -

(2) The credit allowed against the corporate, estate, trust, or individual tax liability for a charitable gift made by a corporation, small business corporation, estate, trust, partnership, or limited liability company directly to a qualified endowment is the percentage, as shown in the following table, of the allowable contribution as defined in ARM 42.4.2701.

Unplanned Gifts by Eligible Entities

Allowable Contribution Qualified Percent of Used to Maximum Charitable Allowable Calculate Credit Gift Date Contribution Maximum Credit Per Year

7/1/03 -

(3) The balance of the allowable contributions not used in the credit calculation may be used as a deduction subject to the limitations and carryover provisions found in 15-30-2131, MCA, or for corporations, the limitations and carryover provisions found in 15-31-114, MCA. (a) Example of an

Time Present Maximum Credit Allowable Period Value Credit Percentage Deduction

7/1/03 -

(b) Example of an

Time Market Maximum Credit Allowable Period Value Credit Percentage Deduction

7/1/03 -

(4) A contribution to a qualified endowment by a small business corporation, partnership, or limited liability company qualifies for the credit only if the entity (5) through (10) remain the same.

AUTH: 15-30-2620, 15-31-501, MCA IMP: 15-30-2327, 15-30-2328, 15-30-2329, 15-31-161, 15-31-162, MCA

REASONABLE NECESSITY: The department proposes amending ARM 42.4.2704 based on the passage of Senate Bill 108, L. 2013, which extended the termination date of the Montana Charitable Endowment Credit from December 31, 2013, to December 31, 2019. The department further proposes making grammatical and punctuation corrections to the rule where needed.

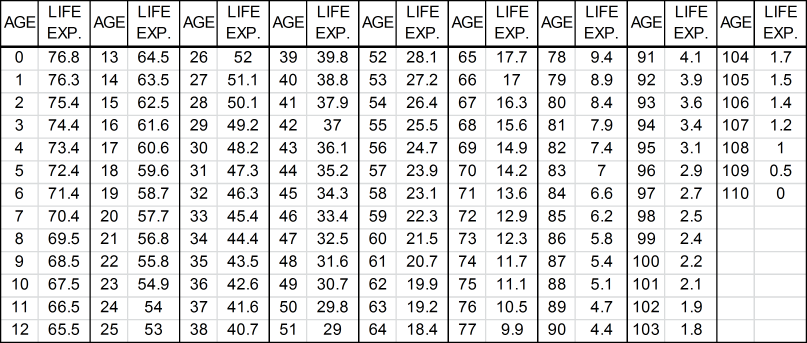

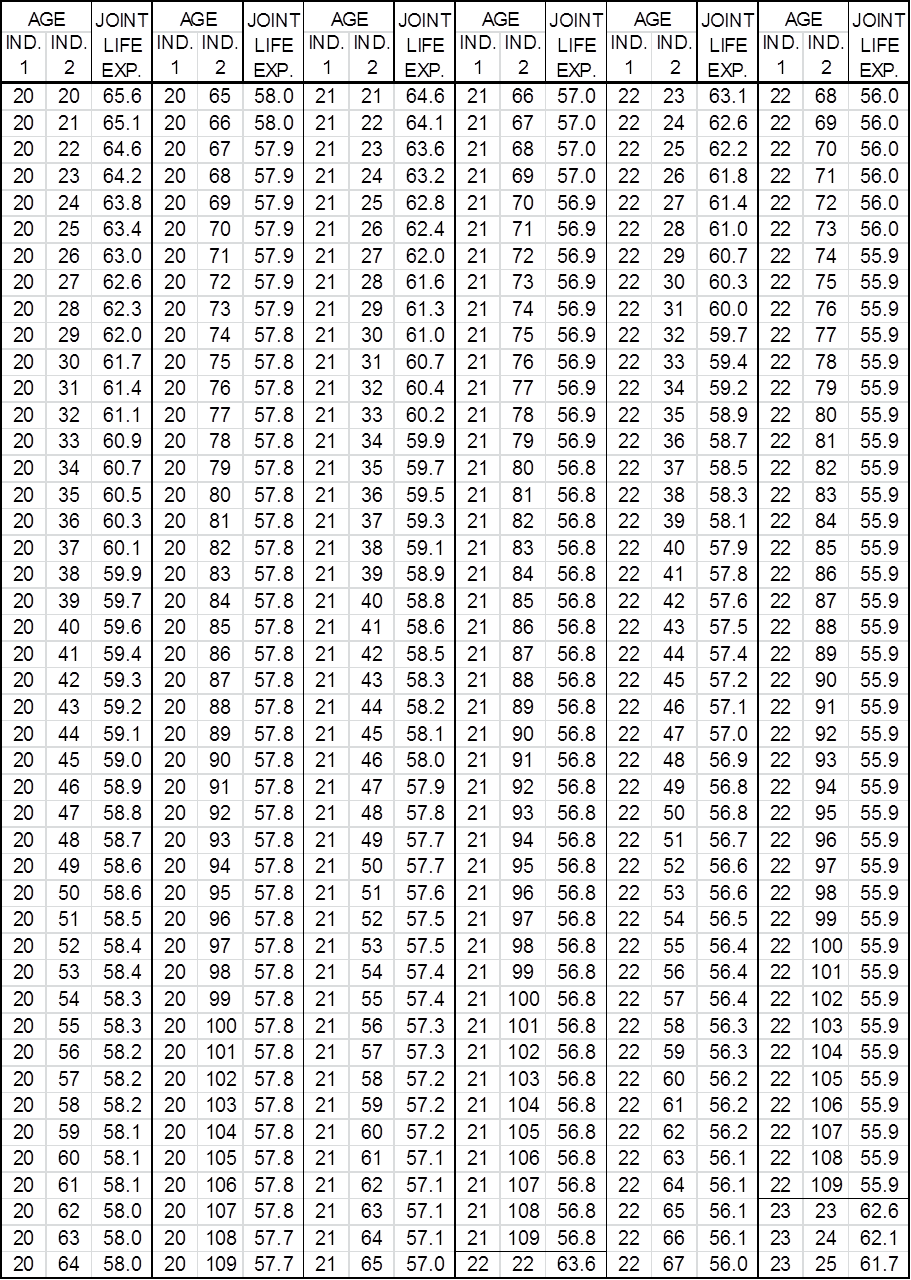

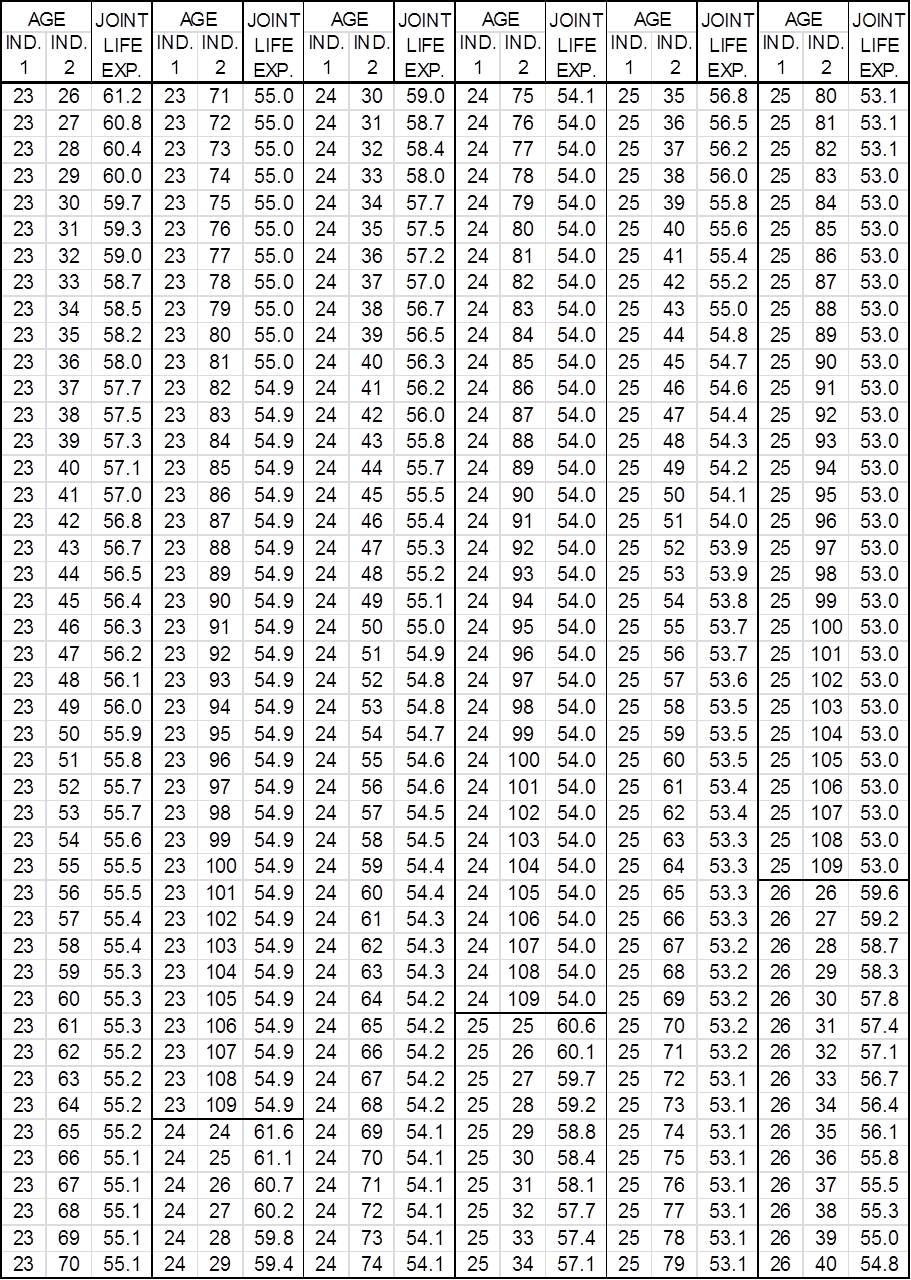

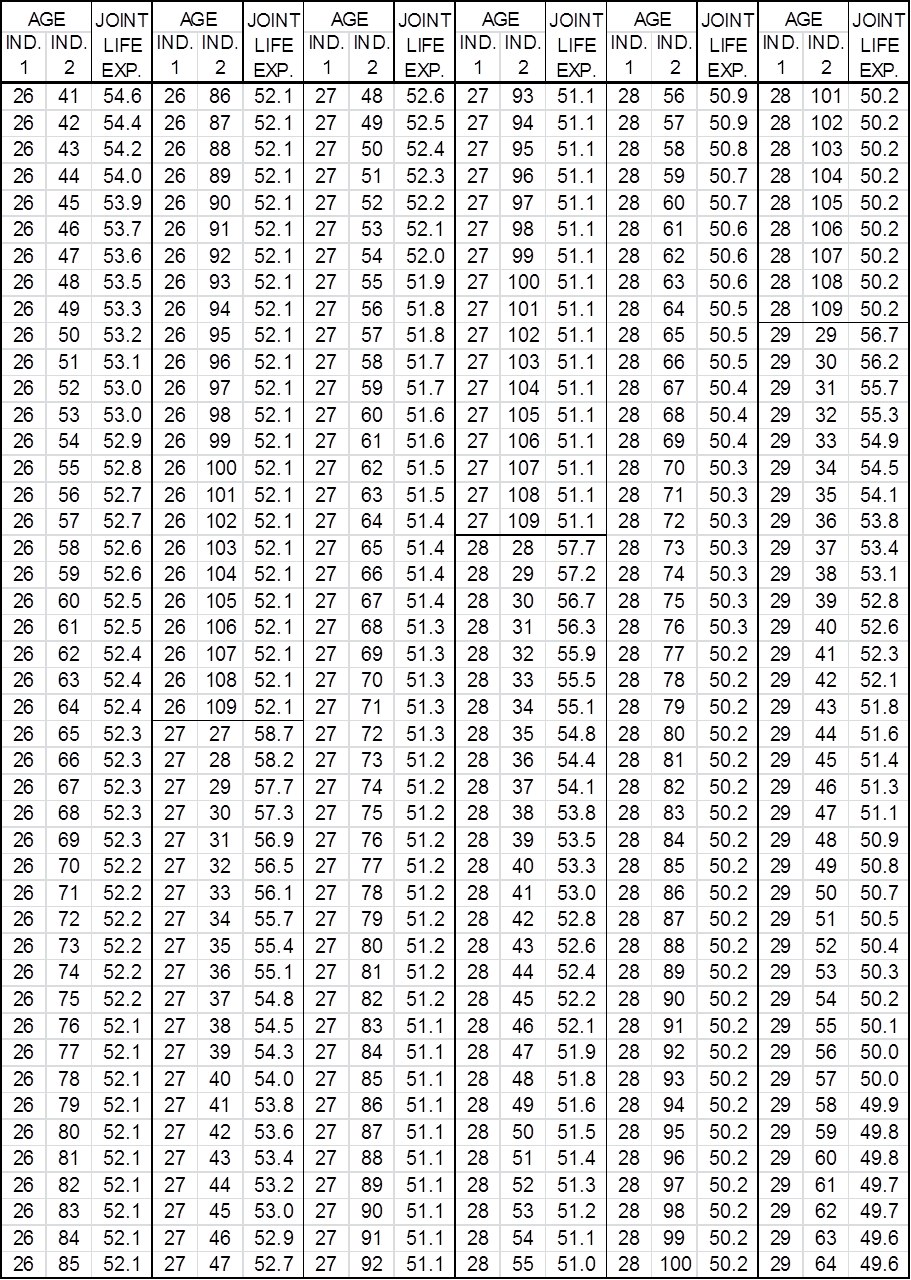

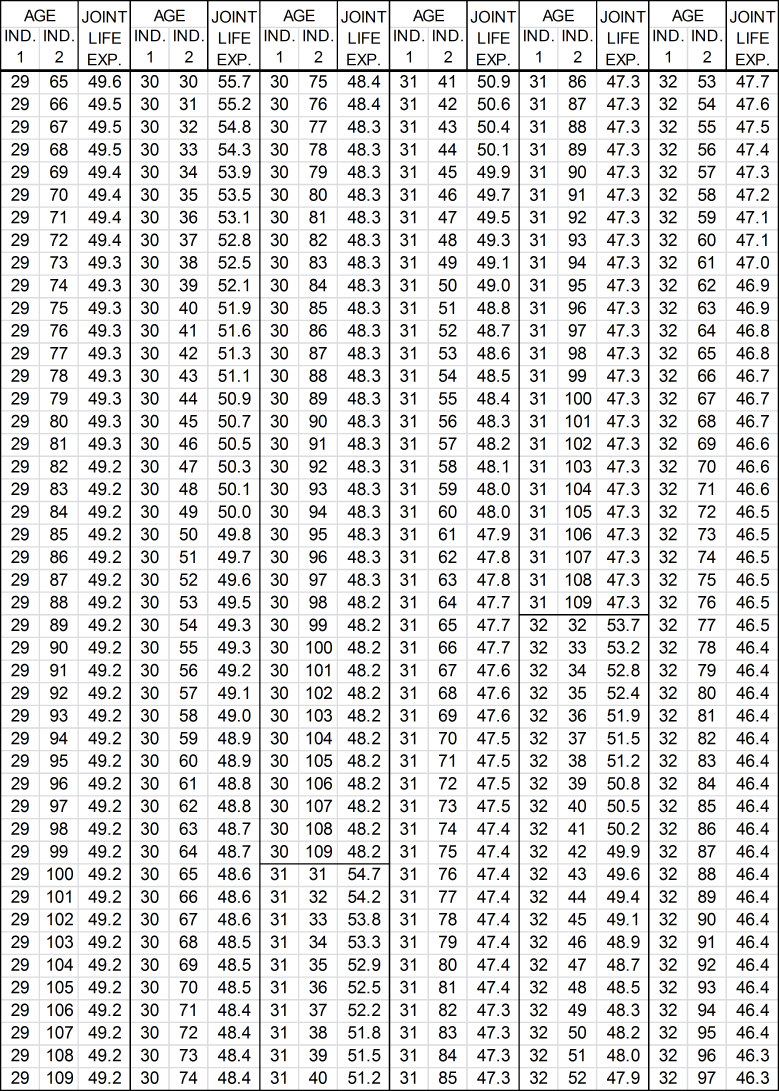

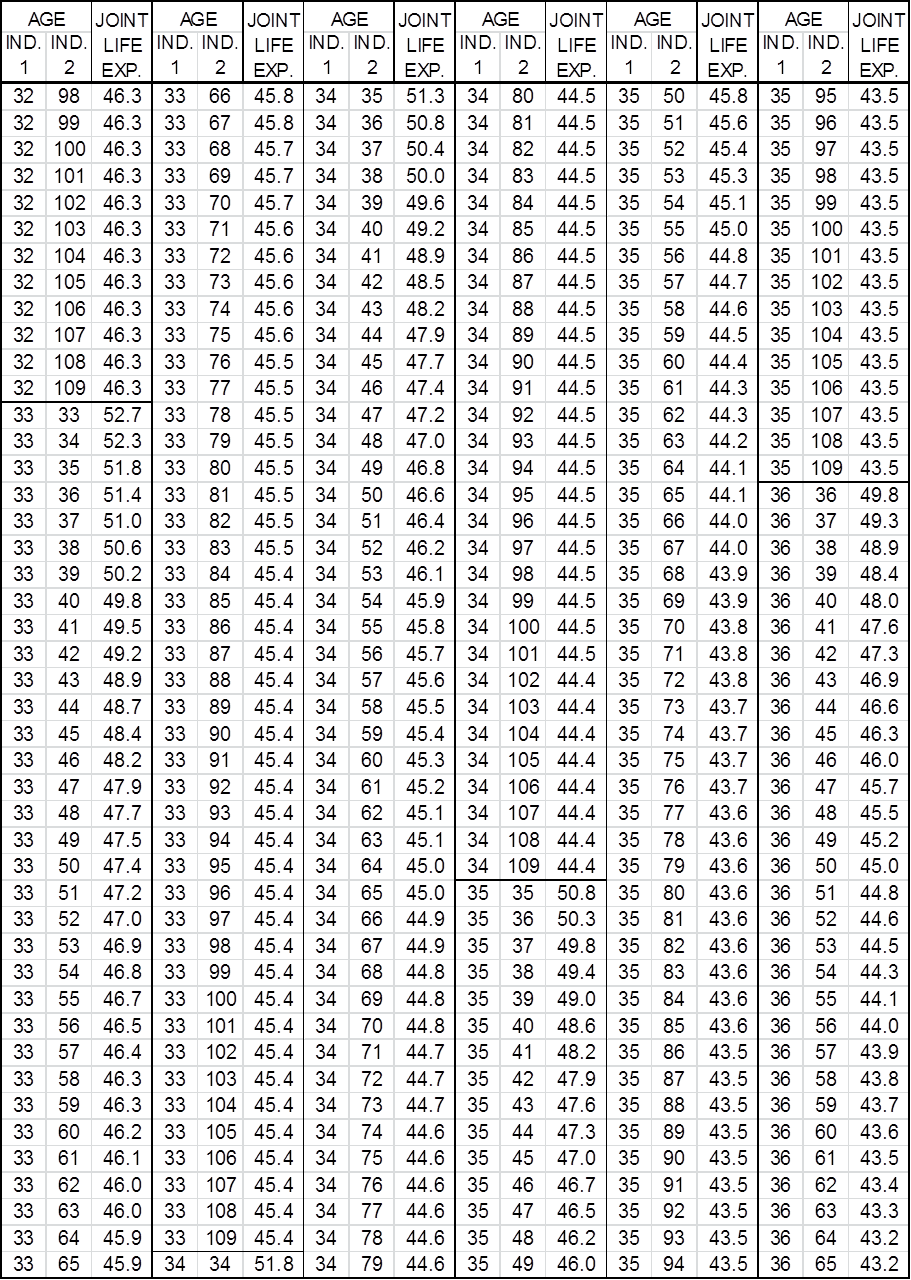

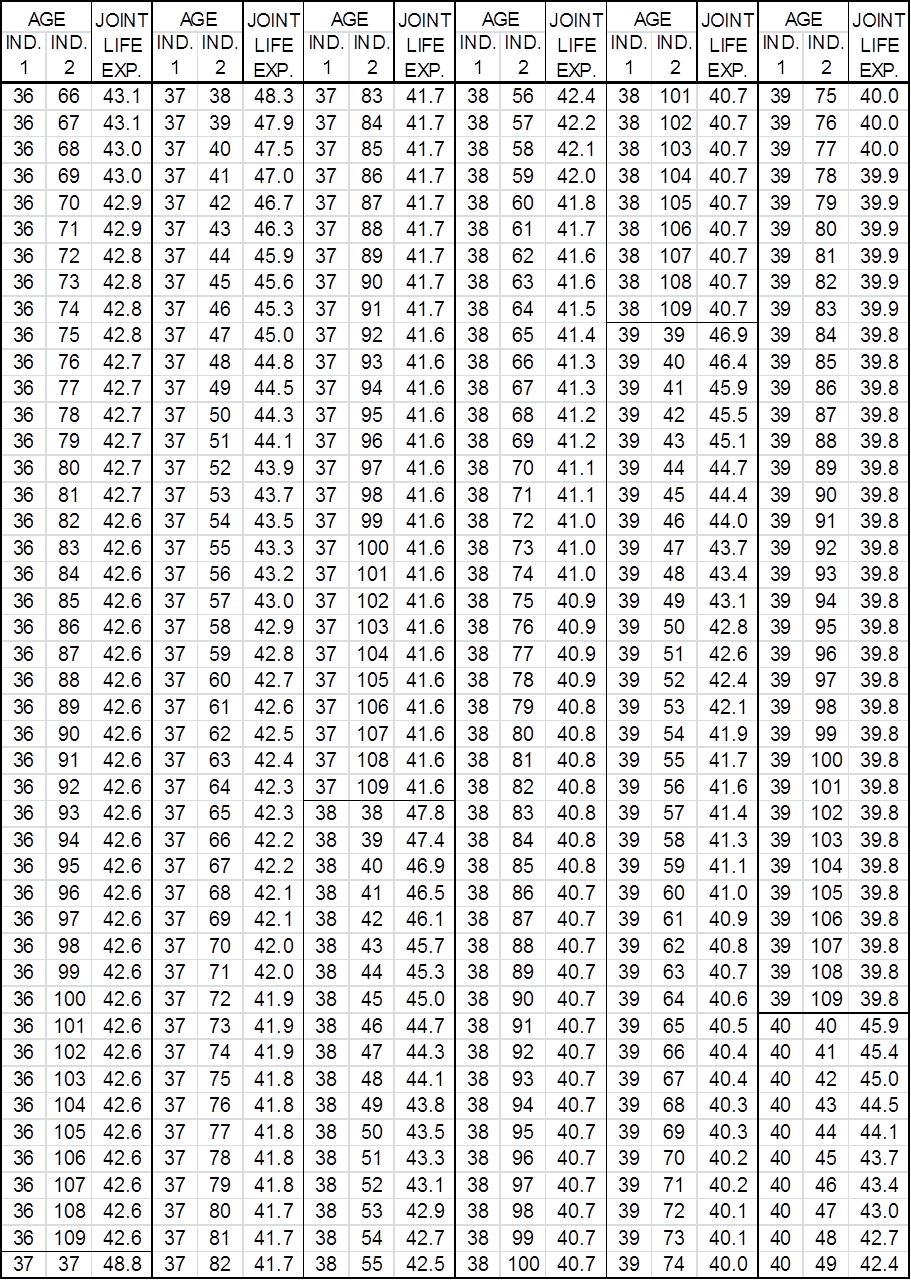

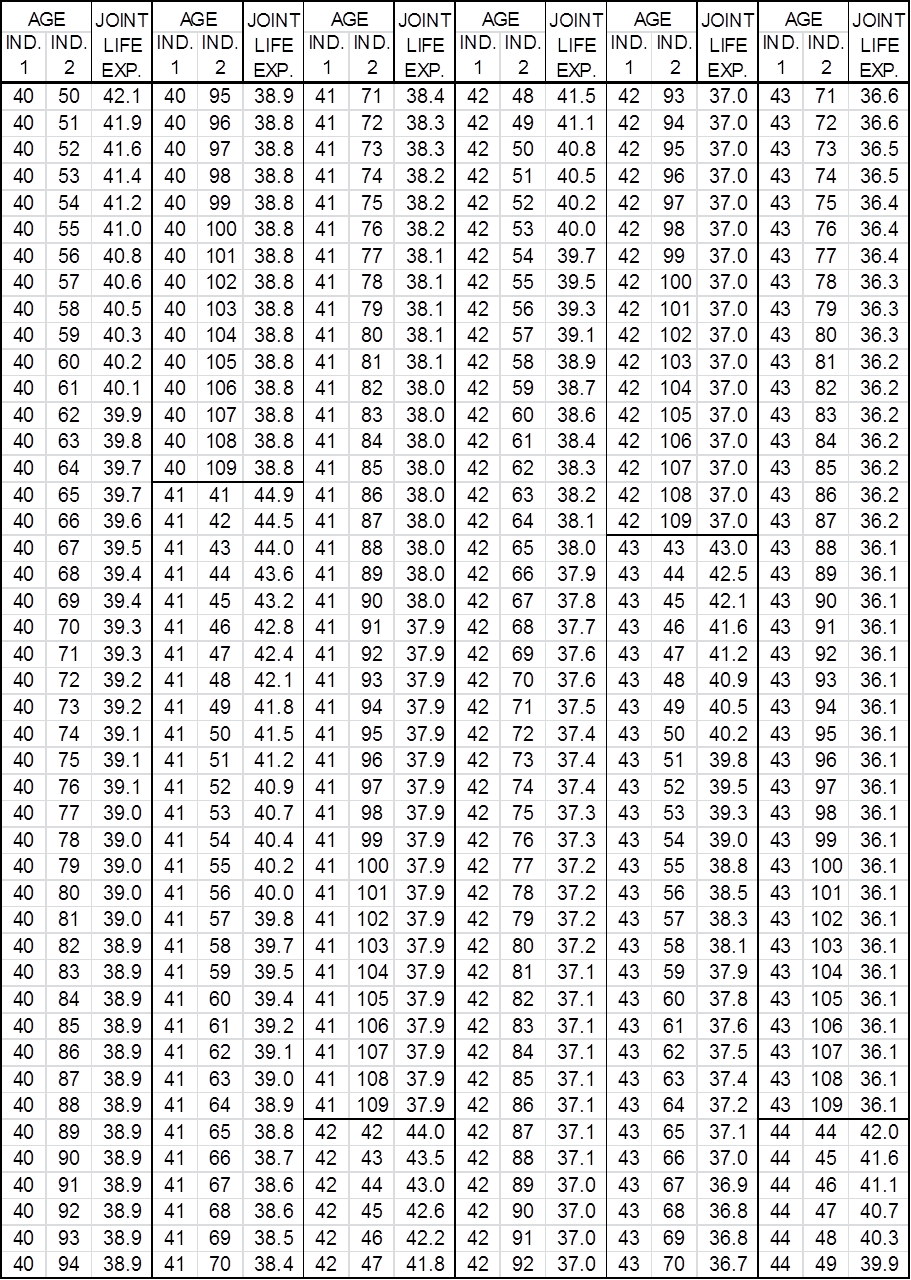

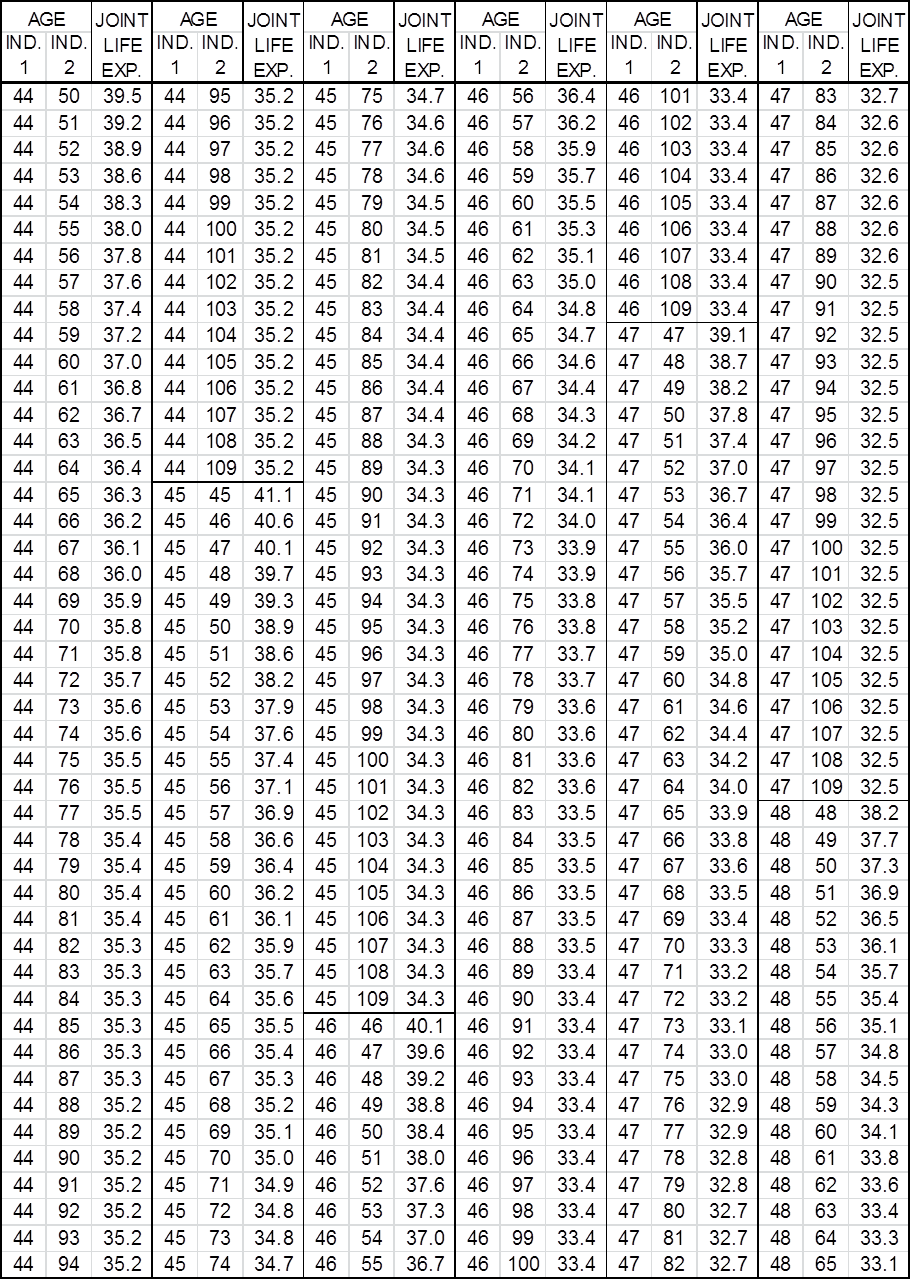

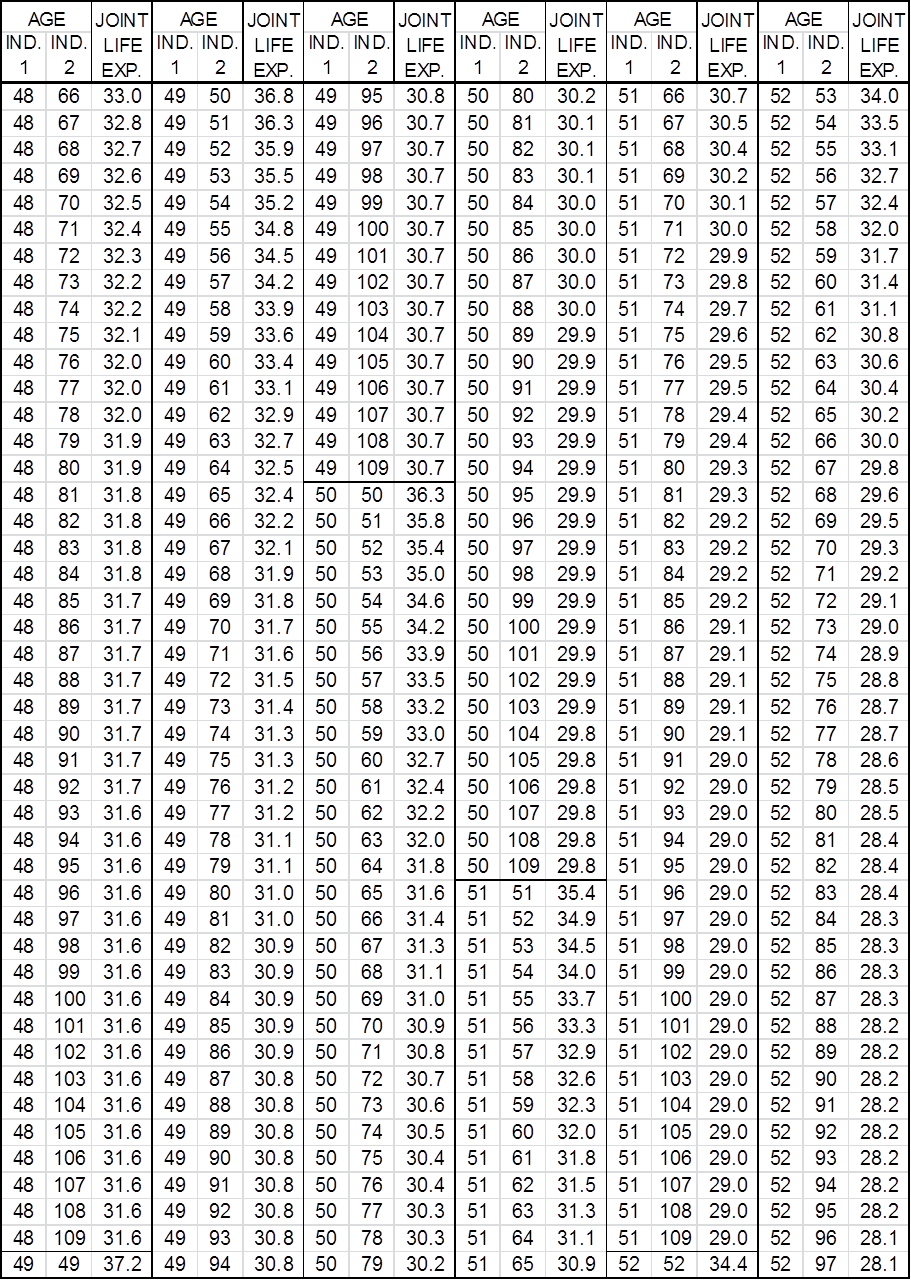

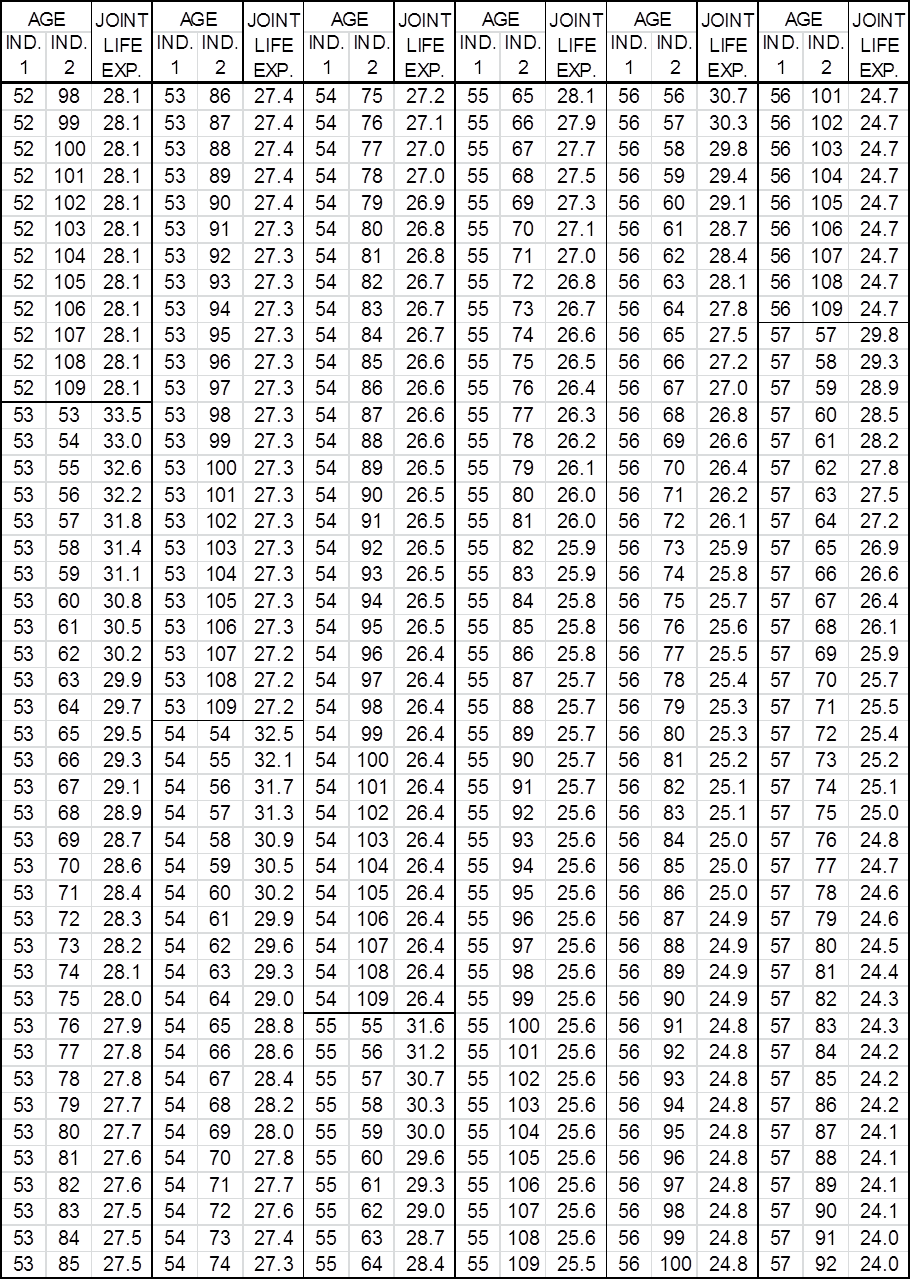

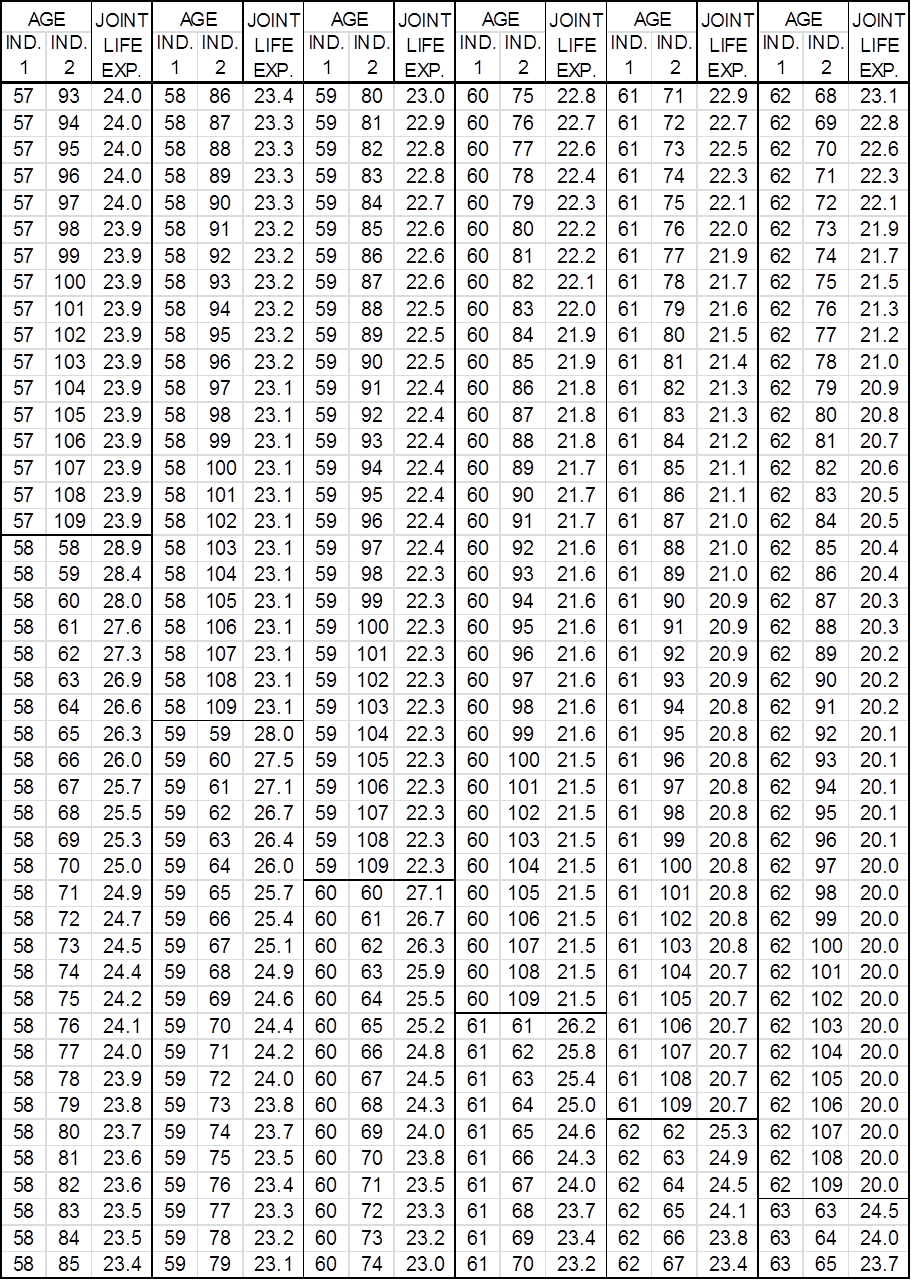

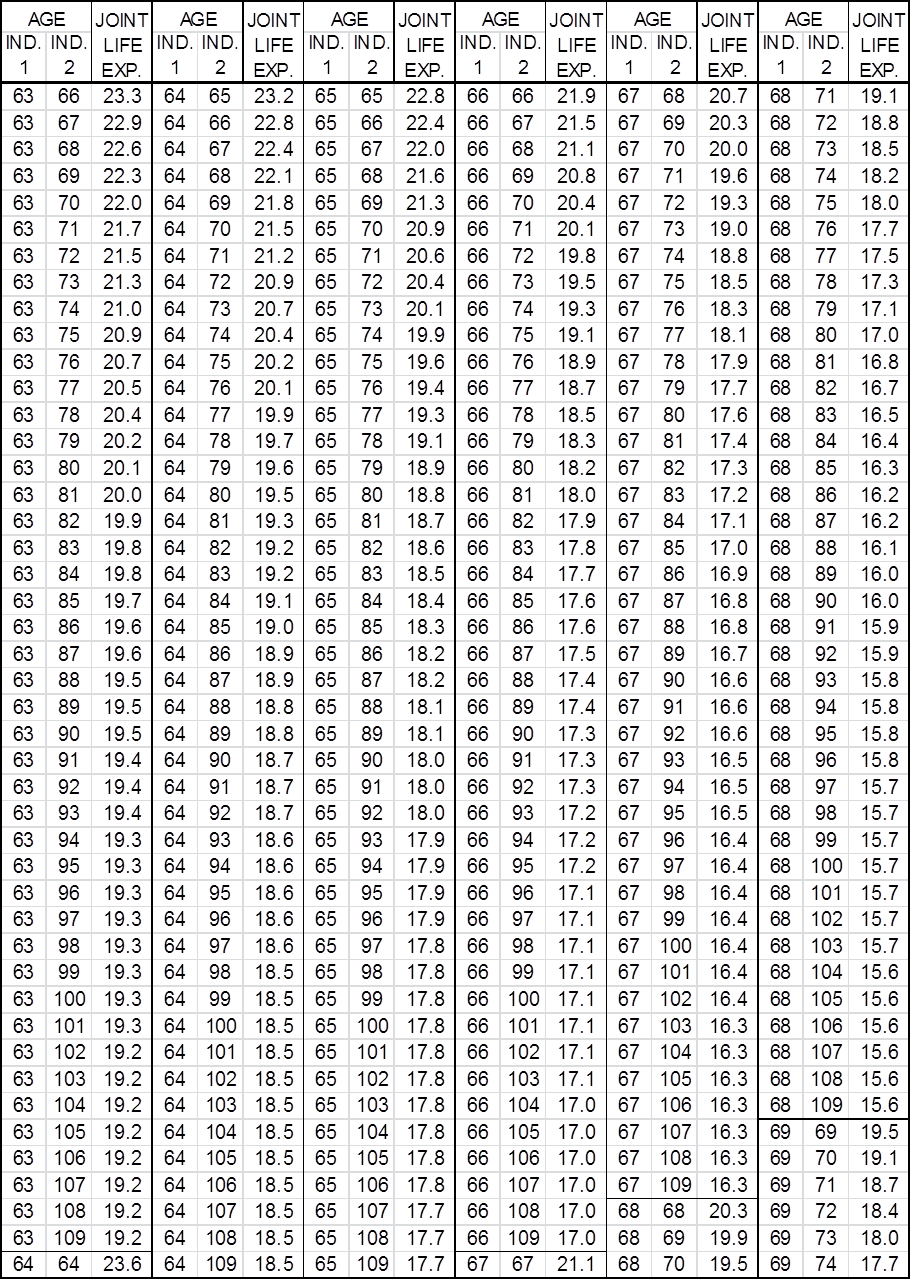

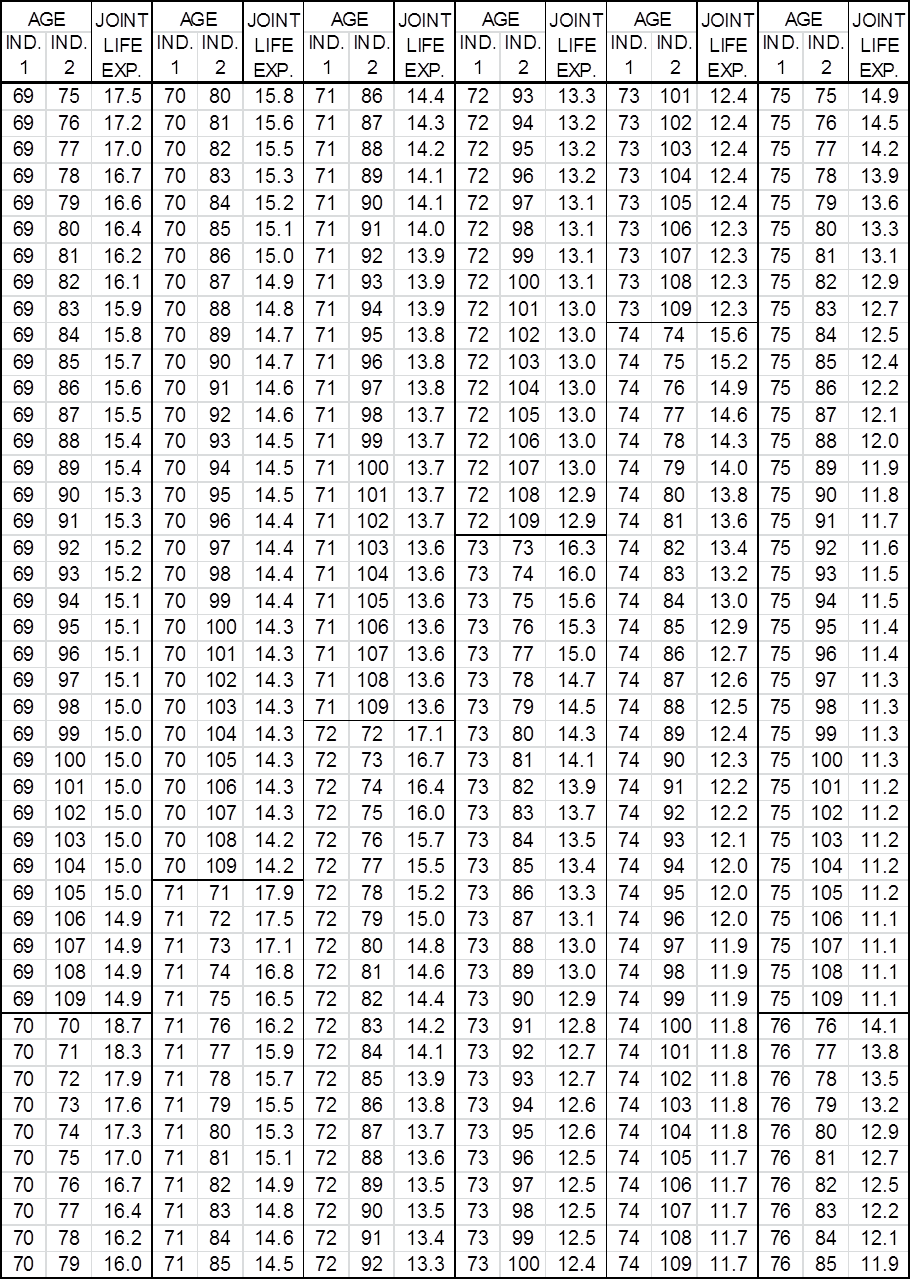

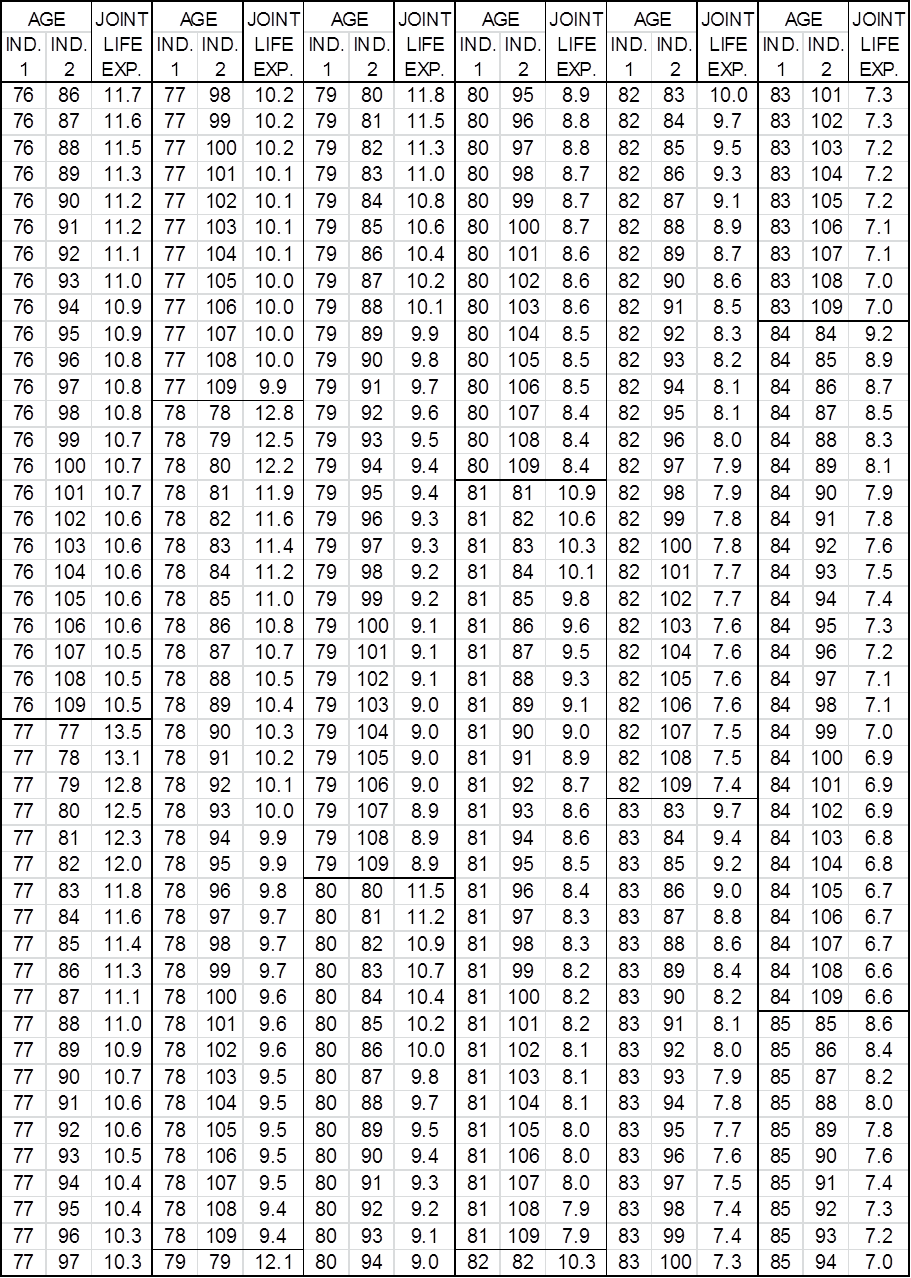

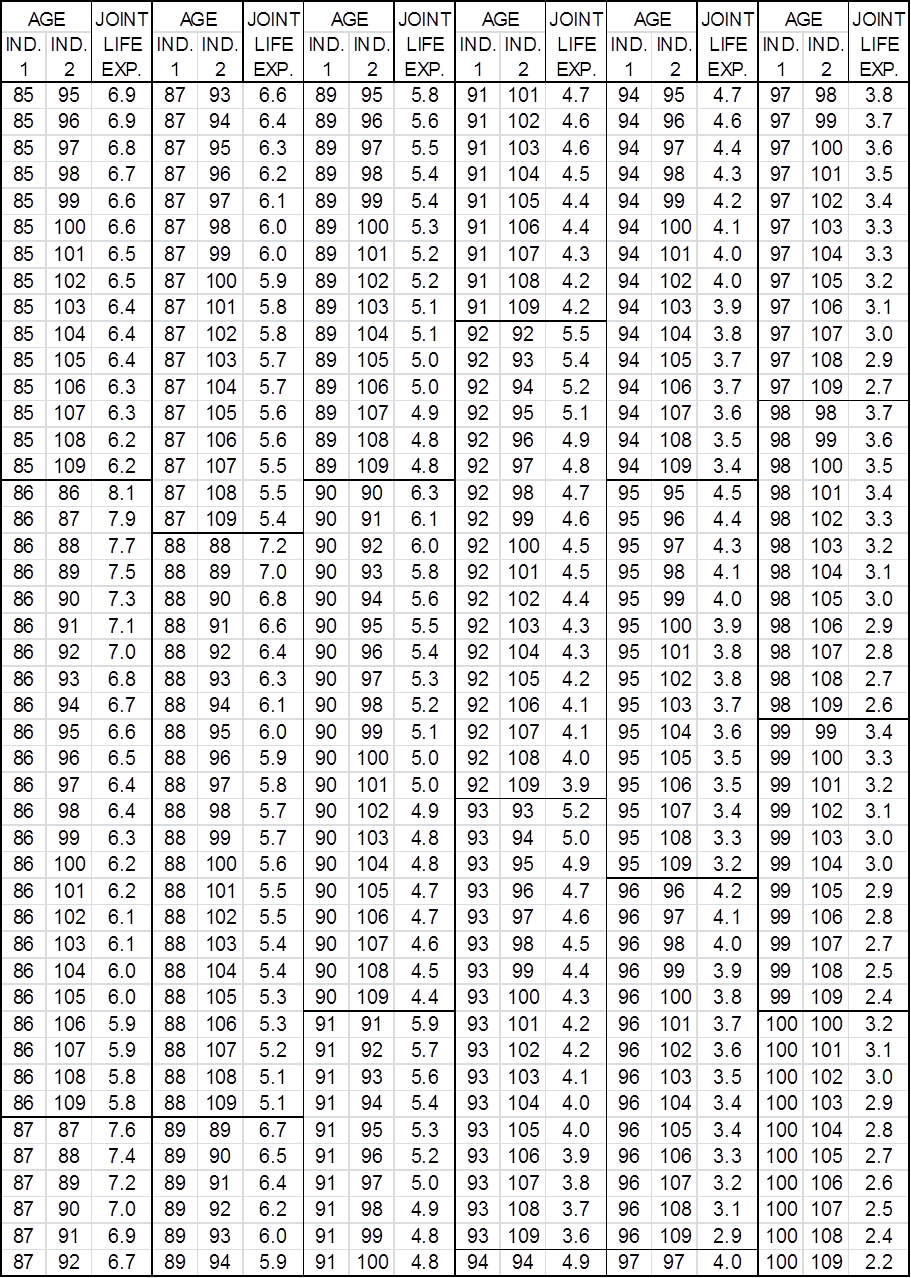

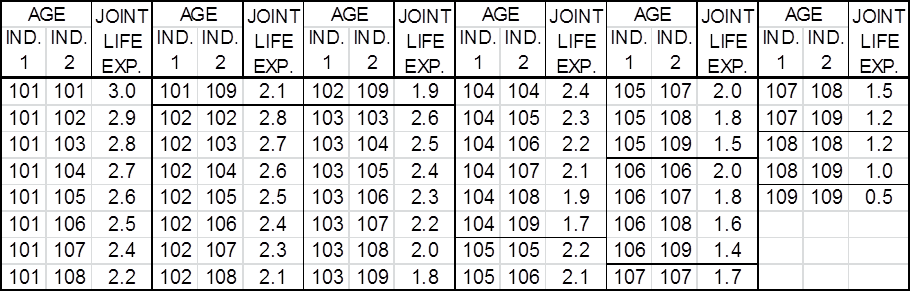

42.4.2708 DETERMINING PRESENT VALUE FOR THE ENDOWMENT CREDIT (1) remains the same. (2) As derived from the May 2009 IRS Publication 1457 titled "Actuarial Valuations," the life expectancy tables that shall be used when determining the present value for the endowment credit are as follows:

Table 1: Single Life Expectancies Based on 2000 CM Mortality

Table 2: Two Life Expectancies Based on 2000 CM Mortality

AUTH: 15-30-2327, 15-30-2620, 15-31-501, MCA IMP: 15-30-2327, 15-30-2328, MCA

REASONABLE NECESSITY: The department proposes amending ARM 42.4.2708 to provide the life expectancy tables used in the calculation of the Montana Qualified Endowments Credit. As required by 15-30-2327(4), MCA, the life expectancy tables were derived from the actuarial tables contained in the most recent IRS Publication 1457 titled "Actuarial Valuations," and are being incorporated as part of this rule. The life expectancy of the donor determines the present value of the gift which, in turn, is used to determine the appropriate amount of the credit.

4. Concerned persons may submit their data, views, or arguments, either orally or in writing, at the hearing. Written data, views, or arguments may also be submitted to: Laurie Logan, Department of Revenue, Director's Office, P.O. Box 7701, Helena, Montana 59604-7701; telephone (406) 444-7905; fax (406) 444-3696; or e-mail lalogan@mt.gov and must be received no later than July 15, 2014.

5. Laurie Logan, Department of Revenue, Director's Office, has been designated to preside over and conduct the hearing.

6. The Department of Revenue maintains a list of interested persons who wish to receive notices of rulemaking actions proposed by this agency. Persons who wish to have their name added to the list shall make a written request, which includes the name and e-mail or mailing address of the person to receive notices and specifies that the person wishes to receive notice regarding particular subject matter or matters. Notices will be sent by e-mail unless a mailing preference is noted in the request. A written request may be mailed or delivered to the person in 4 above or faxed to the office at (406) 444-3696, or may be made by completing a request form at any rules hearing held by the Department of Revenue.

7. An electronic copy of this notice is available on the department's web site, revenue.mt.gov. Select the Administrative Rules link under the Other Resources section located in the body of the homepage, and open the Proposal Notices section within. The department strives to make the electronic copy of this notice conform to the official version of the notice, as printed in the Montana Administrative Register, but advises all concerned persons that in the event of a discrepancy between the official printed text of the notice and the electronic version of the notice, only the official printed text will be considered. While the department also strives to keep its web site accessible at all times, in some instances it may be temporarily unavailable due to system maintenance or technical problems.

8. The bill sponsor contact requirements of 2-4-302, MCA, apply and have been fulfilled. The primary sponsor of Senate Bill 108, L. 2013, Senator Taylor Brown, was notified by regular mail on June 21, 2013, and subsequently notified by regular mail on May 15, 2014.

9. With regard to the requirements of 2-4-111, MCA, the department has determined that the amendment of the above-referenced rules will not significantly and directly impact small businesses.

/s/ Laurie Logan /s/ Mike Kadas ____ LAURIE LOGAN MIKE KADAS Rule Reviewer Director of Revenue

Certified to the Secretary of State June 2, 2014

|

A directory of state agencies is available online at http://www.mt.gov/govt/agencylisting.asp.

For questions about the organization of the ARM or this web site, contact sosarm@mt.gov.